The One Big Beautiful Bill Act (OBBBA) is coming to your home soon, in the form of increased health & energy costs, and swarming ICE agents. Yes, you may see some tax benefits, but they’re not what Mike Lawler wants you to believe. Most of those big beautiful tax breaks will be raining down on the multiple estates and private planes of Jeffrey Epstein’s former pals.

Mike Lawler had the power to stop all of this with his single vote on May 22nd. But that’s not what happened:

In the weeks since, Lawler has been refining his defense of that vote. More of a home show than a road show. Here’s the latest, posted on Wednesday, if you have the stomach to press play on Mike’s stomach:

This is Mike, your off-the-rack neighbor and home SALT salesman.

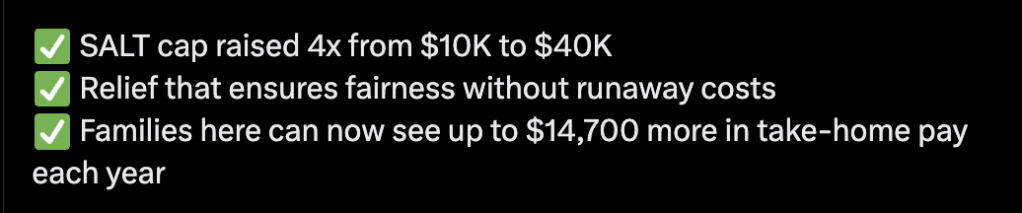

If you went to X and clicked on “Show more,” you would see one additional line in the sales pitch:

Once again, Lawler has chosen to highlight the increased cap for State and Local Tax (SALT) deductions for his NY constituents, here in the land of high taxes and property values. He spent all of his political capital on this issue, so he’s selling it hard.

Let’s look at how Mike’s messaging has evolved by comparing what he said a month ago:

Note what’s missing in this week’s message: any message of relief to “middle and working class families.” Now he’s peddling “real relief for property taxpayers.” Lawler knows who the real winners are. “Further SALT Cap Relief Only Benefits High Earners,” says the Committee for a Responsible Federal Budget, and the Tax Foundation. “High income taxpayers in California and New York set for a SALT windfall in 2026,” ran the headline in Fortune the same day Lawler posted his neighborhood walk.

Also missing from Mike’s summary, the new SALT provisions are only good for 5 years, unlike the many other tax breaks for the rich which were made permanent. And it will cost hundreds of billions of dollars, which will be paid for with Medicare cuts, which he promised he would never do.

Mike takes pride in the fact that the SALT cap increase “was the single largest tax cut in the entire bill.” Again, for the wealthy.

A couple more misleading statements to highlight.

Lawler: “In my district, over 90% of homeowners will be able to fully deduct their state and local taxes.”

While technically true, the vast majority of NY taxpayers will not deduct SALT, because most don’t itemize their deductions. As summarized by the Bipartisan Policy Center:

The primary beneficiaries of the higher SALT cap will be six-figure households in high-tax states…. Low-income and middle-income households will likely not benefit from the SALT cap increase, given that most don’t have $40,000 (or $30,000 or $20,000) in SALT liability. Additionally, the large standard deduction enacted in TCJA (and extended and increased by OBBB) generally outweighs any itemized deductions for most households with more modest income.

The other Lawler head fake:

Lawler: “Families here can now see up to $14,700 more in take-home pay each year.”

This one is highly misleading if not downright false. Read it again: “up to $14,700.” Like when you see “save up to 50%” and discover only one item at 50%, size XXXXL in a strange color. Savings may vary.

Lawler cites analysis from the Council of Economic Advisors (CEA), whose chief economist is Donald Trump. Not literally, but he appointed them all, and they feel the full weight of his discolored tiny thumb, not to mention the threat of horse heads.

Even looking at details of the CEA analysis, Lawler’s summary is a gross misrepresentation. The facts:

- The CEA says a typical NY family with 2 children will see increased annual wages of $8,000 to $11,700. An individual worker can expect $4,400 to $8,000.

- This is compared to there being no OBBBA. The OBBBA is mostly an extension of existing tax benefits, so your current wages won’t really go up by that amount.

- This will happen over 4 years. You won’t see those numbers next year.

- Finally, these are Trump’s economists juicing the numbers. Per FactCheck.org:

CEA estimates were based on an assumption that real, or inflation-adjusted, gross domestic product would increase by more than 4% each year, at least for the first four years under the bills. But the nonpartisan Committee for a Responsible Federal Budget labeled those “fantasy growth assumptions” that “are many times higher” than the estimates of other independent analysts that have modeled versions of the bill. The CRFB said that modelers other than the CEA have projected economic growth in the range of 0.1% to 1.3% per year, producing less of an increase in take-home pay for families.

In summary, Lawler continues to build a house of cards with his OBBBA sales pitch. Watch what happens when somebody turns on the fan.