Mike Lawler likes to go on TV. A lot. He’ll be one of four “battleground members” of Congress participating in a live Town Hall tomorrow night on CNN. Even though he has yet to conduct a live in-person town hall in his district this year.

Lawler TV is not must-see TV. You know what you’re going to get. A mix of Trump and conservative orthodoxy, sprinkled with token nods to common sense, fairness and working across the aisle. For example, his latest interview on Bloomberg TV last Friday, which he featured in a social media post on Monday:

Lawler wants you to know that he’s working across the aisle, demanding tax fairness for the hard-working families of New York. New York has the highest taxes in the country, so a cap on the SALT deduction impacts New Yorkers the hardest. Or, I should say, high-income New Yorkers.

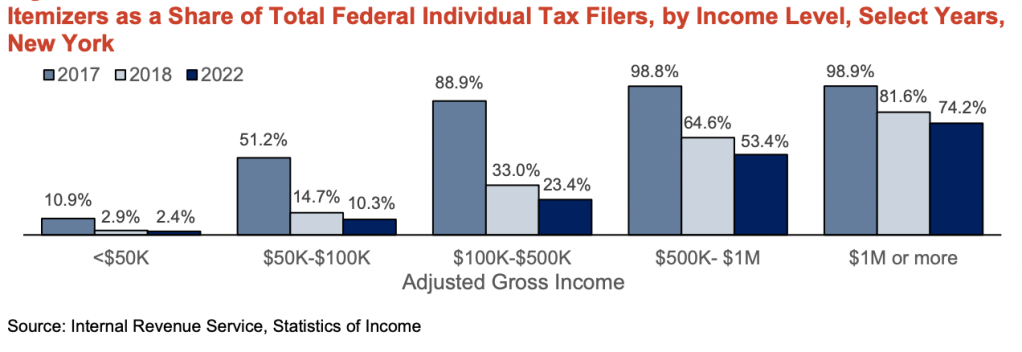

The SALT deduction only matters to those who itemize their deductions. Since Trump doubled the standard deduction in 2017, the percentage of New Yorkers itemizing their deductions has dropped from 35% to 10%. This chart gives you a good idea of who those itemizers are:

The reality of Lawler’s tax policy is that he wants to extend the 2017 Trump tax cuts across the board, which will cost $4T+ over 10 years and disproportionately favor the rich. But he’s also demanding an increase in the SALT deduction cap, which will also disproportionately favor the rich and cost hundreds of billions more. And a tax credit for sports equipment.

If we don’t do this, he says, we’ll be looking at the largest tax increase in history. Well, he already supported the largest tax increase in history, the Trump tariffs. And of course there are alternatives to extending the Trump cuts wholesale. If you’re feeling earnest, help yourself to “A Fiscally Responsible Path Forward on the SALT Deduction Cap,” from the Bipartisan Policy Center.

Lawler and his SALT warriors have reportedly rejected lifting the cap from $10K to $25K. Lawler wants a cap of $100K for single filers, and $200K for married couples filing jointly. The Tax Policy Institute estimates that raising the cap to even $20K would cost $225B and mostly benefit high income households.

Fiscally responsible? No. But it plays well on TV when pitched as a bipartisan call for fairness. So much easier to talk about than the tariffs. Congressman, won’t this trade war impact your ability to extend the Trump tax cuts?

“No, I think obviously short term volatility in the market is a factor that we have to look at. But the reality is that all of the economic decisions uh that are in play, uh is is what we have to focus on uh, you know, putting into effect.”

The “uh” count goes up dramatically.

Expect a sprinkle of SALT tomorrow night on CNN. No need to watch, really. He’ll be posting the best clips on his social media Friday.